- OPERATING EXPENSE RATIO HOW TO

- OPERATING EXPENSE RATIO FULL

- OPERATING EXPENSE RATIO SOFTWARE

- OPERATING EXPENSE RATIO FREE

These systems can cover a variety of tasks, including accounting, website hosting, marketing communications, payroll, and more.

OPERATING EXPENSE RATIO SOFTWARE

There are dozens of online systems and software programs that can automate and streamline the day-to-day functions of a small business.

OPERATING EXPENSE RATIO FREE

This may free up some money that you can allocate to future capital expenditures.

Operating costs are any expenses that are required for the day-to-day maintenance and administration of your business.

OPERATING EXPENSE RATIO HOW TO

The specific costs for hiring labor to produce a product is calculated separately, under cost of goods sold, and are not operating expenses.Quick review: What are operating costs and how to calculate them?

OPERATING EXPENSE RATIO FULL

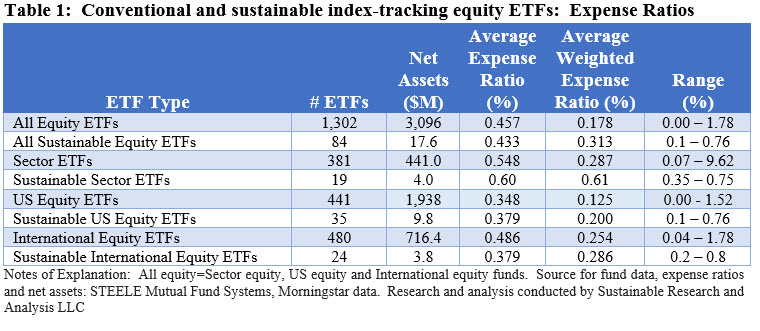

Are Wages Operating Expenses?Īdministrative expenses such as full time staff salaries or hourly wages are considered operating expenses for a business. For instance, if a company owns two similar plants in Michigan, with similar outputs, and one’s OER is 15% more than the other, management should investigate the reasons why. OER can also be used to gauge the difference in operating costs between two properties. A low OER means less money from income is being spent on operating expenses. It is a very popular ratio to use in real estate, such as with companies that rent out units. The operating expense ratio (OER) is the cost to operate a piece of property compared to the income the property brings in. This is because cost of goods sold are directly related to the production of a product, as opposed to daily operations. No, operating expenses and cost of goods sold are shown separately on a company’s income statement.

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. What Does an Increase in Operating Expenses Mean? Operating expenses do not include cost of goods sold (materials, direct labor, manufacturing overhead) or capital expenditures (larger expenses such as buildings or machines). Operating expenses are expenses a business incurs in order to keep it running, such as staff wages and office supplies.

0 kommentar(er)

0 kommentar(er)